The Best Gold IRA Companies Of 2023

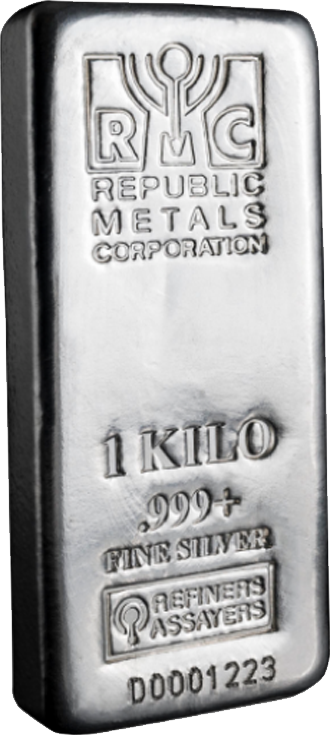

The highest gold investments in IRA firms have transparent and aggressive pricing, and they provide the option to repurchase your precious metals if crucial. For instance, pre-tax funds which can be rolled into a Roth IRA are taxed before they’re transformed into a Roth IRA while after tax funds usually are not taxed. When you put large amounts of cash into a company, you have to make sure you belief it fully. Tax benefits. Gold IRAs offer some of the identical special tax treatment as standard IRAs: Contributions made to conventional self-directed IRAs are tax-deductible. Once you open an account with any company, they’ve annual maintenance costs, doable tax deductions and depositary expenses if you happen to open an IRA. So in case you had been to put money into a gold IRA right now and pull it out a number of years later, you’d achieve a number of revenue. • IRA-permitted gold (and other precious metals) should meet exacting IRS requirements for size, weight, steel purity and design to verify they pass muster as funding-grade belongings.

The highest gold investments in IRA firms have transparent and aggressive pricing, and they provide the option to repurchase your precious metals if crucial. For instance, pre-tax funds which can be rolled into a Roth IRA are taxed before they’re transformed into a Roth IRA while after tax funds usually are not taxed. When you put large amounts of cash into a company, you have to make sure you belief it fully. Tax benefits. Gold IRAs offer some of the identical special tax treatment as standard IRAs: Contributions made to conventional self-directed IRAs are tax-deductible. Once you open an account with any company, they’ve annual maintenance costs, doable tax deductions and depositary expenses if you happen to open an IRA. So in case you had been to put money into a gold IRA right now and pull it out a number of years later, you’d achieve a number of revenue. • IRA-permitted gold (and other precious metals) should meet exacting IRS requirements for size, weight, steel purity and design to verify they pass muster as funding-grade belongings.

As soon as the request is authorised after which the 401(k) firm will send a examine on to the custodian. If you adored this post and you would like to receive additional details regarding irasgold.com kindly go to the page. Whatever decision you make, always be certain that you work with a good and trustworthy gold IRA company. Whenever there is a shift in gold prices, it’s a global shift, so with gold, your money is guaranteed to develop extra. It’s a novel story – a safe approach to learn from high gold costs, with numerous draw back safety. Another draw back is the excessive fees involved in buying and storing bodily gold.

As soon as the request is authorised after which the 401(k) firm will send a examine on to the custodian. If you adored this post and you would like to receive additional details regarding irasgold.com kindly go to the page. Whatever decision you make, always be certain that you work with a good and trustworthy gold IRA company. Whenever there is a shift in gold prices, it’s a global shift, so with gold, your money is guaranteed to develop extra. It’s a novel story – a safe approach to learn from high gold costs, with numerous draw back safety. Another draw back is the excessive fees involved in buying and storing bodily gold.

As soon as a gold IRA is absolutely practical, holders of the account need solely transfer cash into it and start buying gold. It is suggested to maintain only a small portion of your retirement belongings in gold IRAs. Before deciding to trade in financial instrument or cryptocurrencies try to be totally knowledgeable of the dangers and costs related to trading the monetary markets, carefully consider your investment aims, level of experience, and threat appetite, and search professional recommendation where needed. Before proceeding, it’s essential that you simply consider your funding aims, threat tolerance level, and time horizon.

Browse GoldSilver.com’s catalog of the most well-liked and liquid metals funding options. Diversifying your funding portfolio with precious metals may be useful when working with a nicely-established provider providing diverse product choices. Determine on what works best for you based mostly on your investment plan and monetary goals. You often need to fill out an utility either on-line or on paper, and the account is often arrange inside 24 to 48 hours after the applying is accomplished and received. They offers you an application kind to fill in and will assist to complete the transfer. This close to-indestructible valuable steel has inherent qualities that give it vital industrial functions, making it a valuable funding asset and store of wealth.