Treasured Metallic IRA: How To Take a Position For Retirement With Gold And Silver

Gold IRA companies present knowledgeable recommendation and guidance. Business Client Alliance offered them with AAA score, with 3 complaints that has up to now been closed. Tyler guided Regal Assets to be the top 20 in INC Magazine’s fastest rising private financial providers within the US, additional establishing its presence because the solid alternative in opening IRA gold rollover accounts. In addition, he’s earned a number of accolades, including appearing as a part of Inc Magazine’s High 500 list and appearing on Smart Cash. This firm is our second selection as the top precious metals IRA service. Our Top Really helpful Gold IRA Company for six Years Straight! Unfavorable posts or comments are listed proper together with optimistic experiences – it’s a uncommon firm that does not ever have one complaint, however the trick is to see how that firm handles the complaint or negative publish. Based on the Bureau of Labor and Statistics, 20% of small businesses fail of their first year.

Additionally, they’ve obtained an Aplus grade from Higher Enterprise Bureau. Augusta haven’t had a single difficulty with the BCA (Business Shopper Alliance) or BBB (Higher Enterprise Bureau) since its inception by the BBB in 2012. This makes it stand out among businesses that provide gold IRAs. Gold IRA Companies are specialized financial institutions that supply Individual Retirement Accounts (IRAs) backed by physical gold or other precious metals. Offered the refinery or mint is NYMEX or COMEX approved or a government mint and meets purity requirements then you should only be concerned with shopping for as much gold as you can to your greenback. There’s been lots of talk out there about the federal government taking away retirement accounts similar to has been achieved in Portugal, Poland, and already for some within the U.S. In the event you loved this information and you want to receive much more information concerning Irasgold.Com i implore you to visit our own web site. Whenever you purchase this precious metallic jewellery as an investment, you get to preserve wealth over a long time. Whereas a direct transfer of funds from one account to a different sounds simple in concept – in follow there are some providers who don’t all the time work nicely with others and need to pre-approve the switch.

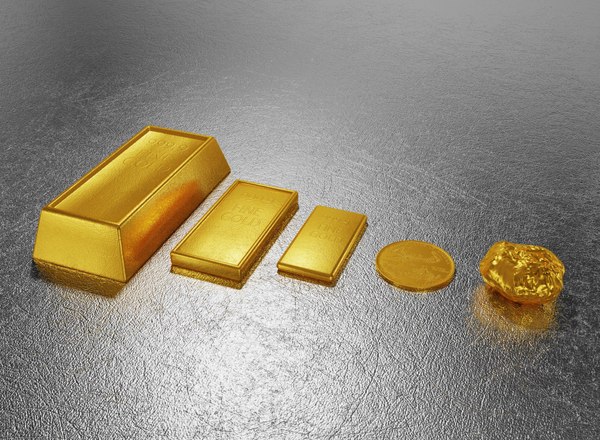

While you don’t have to take distributions from your personal Roth IRA, an inherited Roth IRA usually has RMDs. With so many designs accessible in goldjewellery and silverjewellery, it solely makes sense to increase your jewellery collection infrequently. Gold and silver bullion and uncommon coins are recognized to have more value with age so for a long run funding they would be an exquisite choice. In terms of investing in a gold IRA, choosing the suitable gold IRA custodian is crucial to ensure the safety and legitimacy of your investment. Protect Your Wealth with Augusta Valuable Metals: The final word Investment Answer! Their costs are often less than the bottom worth however this has the best risk of all. You are taking a further tax hit, with no credit score being given for earlier penalty tax. Sure, you’ll receive quarterly statements from your gold IRA custodian. Will I receive statements for my gold IRA?

While you don’t have to take distributions from your personal Roth IRA, an inherited Roth IRA usually has RMDs. With so many designs accessible in goldjewellery and silverjewellery, it solely makes sense to increase your jewellery collection infrequently. Gold and silver bullion and uncommon coins are recognized to have more value with age so for a long run funding they would be an exquisite choice. In terms of investing in a gold IRA, choosing the suitable gold IRA custodian is crucial to ensure the safety and legitimacy of your investment. Protect Your Wealth with Augusta Valuable Metals: The final word Investment Answer! Their costs are often less than the bottom worth however this has the best risk of all. You are taking a further tax hit, with no credit score being given for earlier penalty tax. Sure, you’ll receive quarterly statements from your gold IRA custodian. Will I receive statements for my gold IRA?

Thus investing in gold and silver is certainly a sound financial plan that may only show to be a profitable funding possibility. They offer quite a lot of gold IRA services, together with a wide number of gold coins and bullion, and supply an easy-to-use online platform for gold IRA transactions. That explains how they “may be” paid by the dealers they’re recommending. When you purchase gold coin, chances are you’ll consider getting a financial institution safe deposit field, a home protected or you might acquire safekeeping amenities which might be being provided by gold dealers. The good news is that some conditions may let you keep away from the 10% penalty – however not the taxes. Suspecting that commodities markets are dangerous places pushed by cut-throat skilled traders and fund managers, most abnormal folks assume that gold worth and values of other precious metals have little to do with them. When you wish to promote, you’ll be able to easily search for locations to promote gold and make your suitable selection. A standard IRA is not taxable until the money is withdrawn, that may solely be made until after the age of 59 ½. The corporate’s secure storage amenities and safe online platform present shoppers with peace of thoughts, realizing their gold investments are safe. Titanic knowing its past historical past, would you accept the crew member’s life preserver certificate, or the precise life preserver?